Calculate federal withholding per paycheck 2023

Multiply taxable gross wages by the number of pay. You can use the TurboTax W-4 withholding calculator to easily walk you through your withholding adjustments and help you fill out IRS Form W-4 Employee Withholding Certificate.

1

The result is net income.

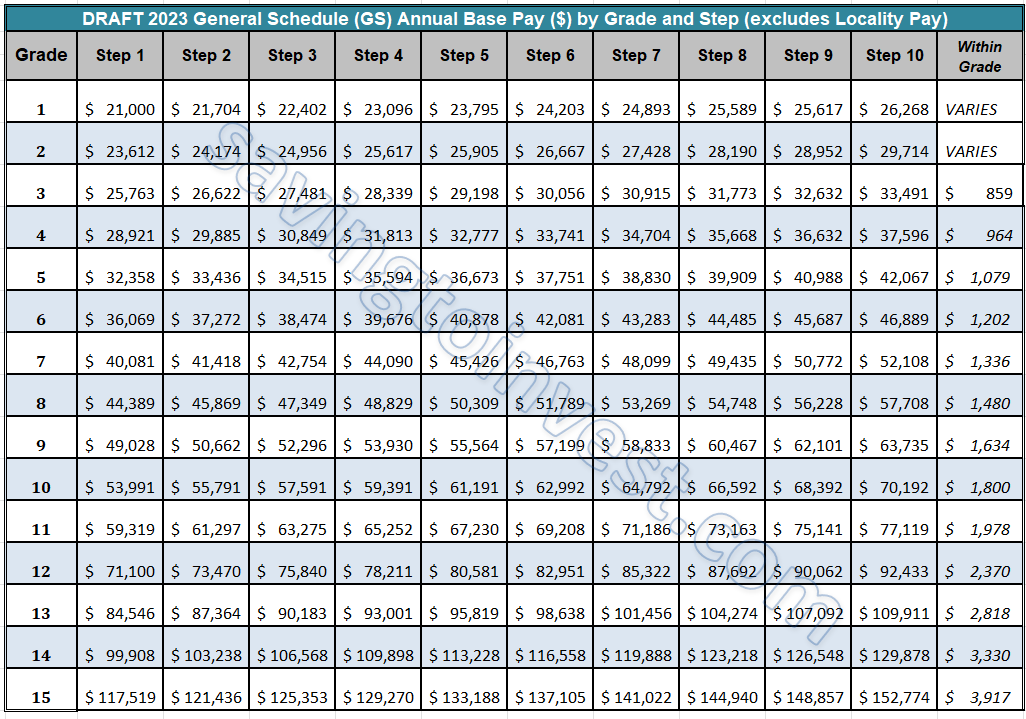

. The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees. To calculate Federal Income Tax withholding you will need. The employees adjusted gross pay for the pay.

Ad We Automate Your Payroll. Read Our Success Stories See How We Help Companies Grow. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

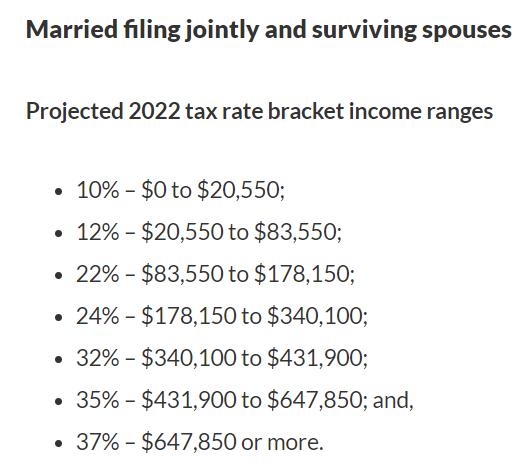

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. Jul 07 2022 Calculate your adjusted gross income from self-employment for the year. 2022 Federal income tax withholding calculation.

Ad Payroll So Easy You Can Set It Up Run It Yourself. 250 minus 200 50. Simplify Your Day-to-Day With The Best Payroll Services.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Based on your projected tax withholding for the year we can also estimate your tax refund or. Free Unbiased Reviews Top Picks.

Once you have a better understanding how your 2022 taxes will work out plan accordingly. 48 Hr USA Set Up. Prepare and e-File your.

Then look at your last paychecks tax withholding amount eg. Prepare and e-File your. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Ad Compare This Years Top 5 Free Payroll Software. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Our 2022 GS Pay.

That result is the tax withholding amount. Enter your filing status income deductions and credits and we will estimate your total taxes. 2022 Federal income tax withholding calculation.

Calculate for multiple jobs or a working spouse. It will be updated with 2023 tax year data as soon the data is available from the IRS. Ad Check Out Our Best Paycheck Software Reviewed By Industry Experts.

There are two main methods small businesses can use to calculate federal withholding tax. The wage bracket method and the percentage method. Get Started Today with 2 Months Free.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. How to calculate annual income. Subtract 12900 for Married otherwise.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Get Your Quote Today with SurePayroll. IRS Tax Tip 2022-66 April 28 2022 All taxpayers should review their federal withholding each year to make sure theyre not having too little or too much tax withheld.

Enter your personal information. This 2022 tax return and refund estimator provides you with detailed tax results during 2022. 250 and subtract the refund adjust amount from that.

Life events such as marriage divorce having a baby or. Welcome to the FederalPay GS Pay Calculator. 48 Hr USA Set Up.

Calculate Federal Income Tax FIT Withholding Amount. Read Our Success Stories See How We Help Companies Grow. For example if an.

Ad We Automate Your Payroll. All Services Backed by Tax Guarantee.

Pay Scale Revised In Budget 2022 23 Chart Grade 1 To 21 Bise World Pakistani Education Entertainment Salary Increase Math Tutorials Salary

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

2

2023 Va Disability Pay Dates The Insider S Guide Va Claims Insider

1

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

1

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

How To Pay Payroll Taxes A Step By Step Guide

Prjije5rjguwlm

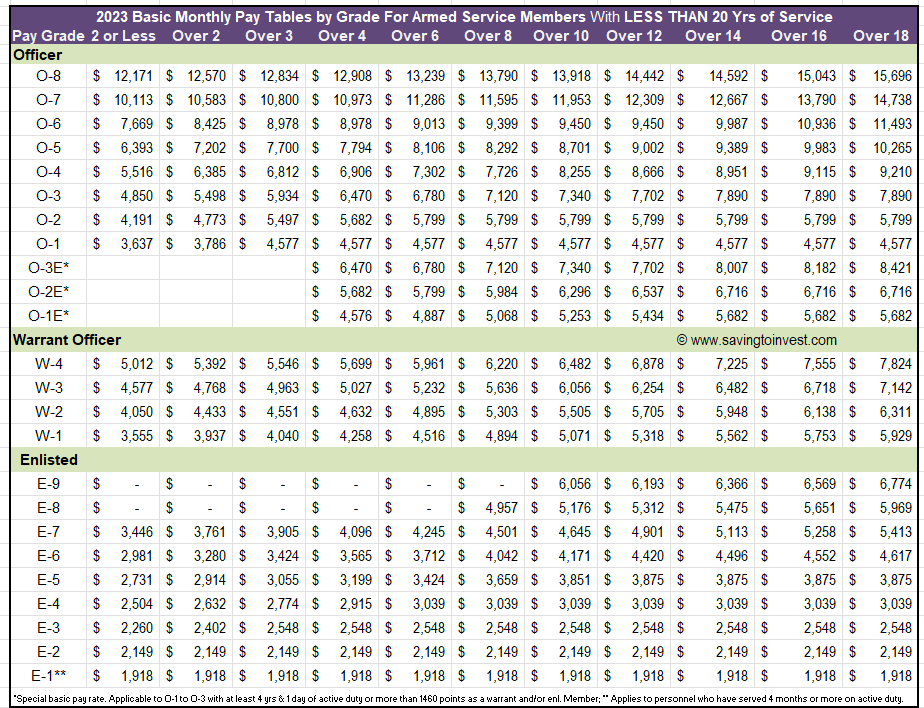

2023 Raise To 2022 Military Pay Charts Updated Monthly Basic Pay Tables For Armed Service Members Aving To Invest

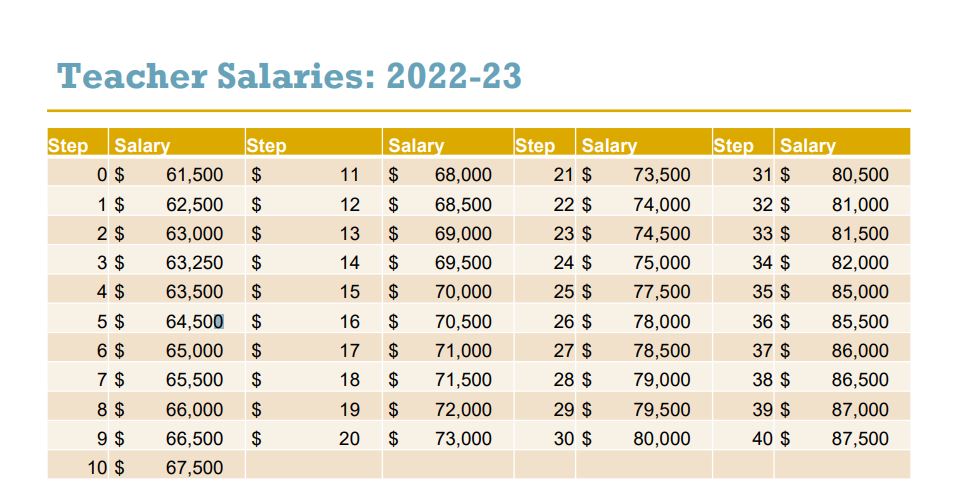

Hisd Trustees Unanimously Approve 2 2 Billion Budget And Highly Competitive Teacher Pay Raises News Blog

2023 Military Pay Chart 4 6 All Pay Grades

Collin County College Calendar Collin County Calendar Board College

Independent Contractor Pay Stub Template Payroll Template Fake Money Printable Payroll Checks

Estimated Income Tax Payments For 2023 And 2024 Pay Online

1